This subject has received a massive amount of press, almost all of it referring to tax increases. Many articles have cited businesses closing or laying off staff.

So how dreadful is it?

One thing which nearly all omit to mention is the fact that the Employment Allowance will increase from £5,000 to £10,500 per year. This is deducted each year from the total employer’s NI bill.

This offsets the changes:

- 1.2% increase in Employer’s rate from 13.8% to 15%

- a reduction in the “tax free threshold” from £9,100 to £5,000

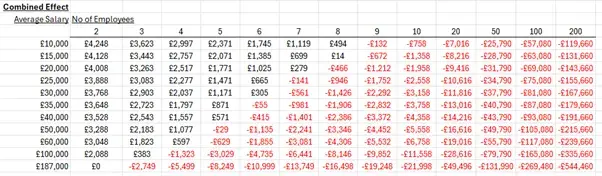

Putting the 3 parts together results in the following table:

So clearly some businesses will be better off, and others will be paying more.

A business with two employee directors will be significantly better off. In fact, the salary for each would have to be £187,000 to eliminate the benefit of the additional Employment Allowance.

A business employing a high proportion of part-time staff on low wages – the hospitality trade for example – will only be paying more above 7 employees but the bigger employers will be hit. For example, 50 employees would add 3% to the wage bill. Of course that is before the increase in the minimum wage.

The average salary in UK is just under £30,000. A business paying this will be better off up to 6 employees. Thereafter, costs rise steadily. With 100 employees, the additional cost is £81,080 which is 2.7% of salary.

The impact is skewed to the number of people employed - this is because of the significant Employment Allowance increase.