The COVID pandemic has had a dramatic affect on many aspects of our daily lives. For businesses though some aspects of these changes are likely to have a lasting impact and may even become a new type of business as usual. In this blog we look at the arguments for why COVID has made the arguments in favour of outsourcing bookkeeping even stronger than pre-COVID.

The challenges of shifting from an office based role to Hybrid working or working from home.

The ease at which businesses have been able to adapt to hybrid or home working has varied greatly from business to business. Some firms didn’t have the technology in place to facilitate this, the quality of supervision and quality control / oversight varied greatly. These difficulties would be a problem for any role, but when it is in a crucial area such as finance and an area like bookkeeping then it can threaten the very existence of the business itself. Inaccurate information, failing to meet HMRC deadlines, losing a grip on cashflow and debtors, are all possible consequences. Outsourcing alleviates these concerns as it is the outsourcing organisation’s responsibility to ensure that none of these problems occur.

Over reliance on one person or a small team

Many businesses don’t have the luxury of a large finance team, relying instead on one person or a small team. When this person or a key part of a team is ill or the productivity, quality or accuracy of their work suffers, then it can quickly impact on the business. With an outsourced solution they have the responsibility of maintaining business as usual when somebody is off ill on holiday and their management structure will ensure service levels are maintained at the required level.

Difficulties in retaining staff or recruiting replacements

COVID has made it even more important that businesses retain key staff and where this is not possible recruiting has become more difficult than ever. Businesses that outsouce their bookkeeping don’t have this headache as it becomes the responsibility of the outsourced provider.

Wage inflation pressures

Labour shortages in many areas is leading to upward pressure on wages. For some businesses wages have had to be increased to improve the chance of retaining staff. For other firms they have found they have had to increase wages to attract recruits for vacant roles. With an outsourced solution these pressures have to be handled by the outsourced service provider.

COVID has sharpened the focus on the need for understanding a businesses performance and quality management information

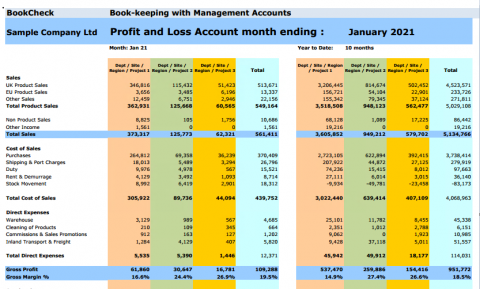

Understanding how a business is performing, particularly around areas like debtor days and the relative profitability of different products or services has always been vitally important. A crisis such as a pandemic makes this even more important and can quite literally be the difference between a businesses failure or survival.

BookCheck are experts and specialists at providing outsourced booking with management information and payroll services. BookCheck can provide an extensive list of references that are testament to the quality and the reliability of their services. If you would like to find out more about BookCheck’s services or you would like to contact our team to find out how we can help then you can visit our website https://www.bookcheck.co.uk/